Your credit plays an important role in your life. It determines if you are able to secure loans, credit cards, purchase a home or even get a promotion. Taking care of your credit and using it responsibly is the best way to cultivate a good score and keep it in the higher numbers. However, sometimes life comes along with situations that can cause your score to fall.

Regardless of the reason for a low credit score, there are things you can do to bring your credit back into good standing. We have put together a guide that will help you improve your credit score in six months or less to help you get started.

What Is A Good Credit Score?

A couple of different factors determine if a person has good credit. One is their debt to income ratio, and the other is the score. An average credit score is considered anything over 690, while excellent credit is 780 or above. In reality, most consumers have credit that falls between 600 and 710. Anything under 600 is considered poor credit. With you have poor or bad credit, it can make it much harder to do the things you want or it can even stop you from reaching your goals.

Your debt to income ratio is the amount of debt you have compared to your available lines of credit. You can have a high credit score, but if you are using most or all of your available credit, lenders may still not approve your applications for new loans.

Check Your Credit Report Often

The best way to start fixing your credit is by checking your credit report. Your report will contain information about your purchases and loans over the last 10 years. Usually, a credit report will contain aggregated scores from Equifax, Experian, and TransUnion. While most reports are accurate, there are times when a company may only report to one of the three bureaus which can result in lowering your credit score.

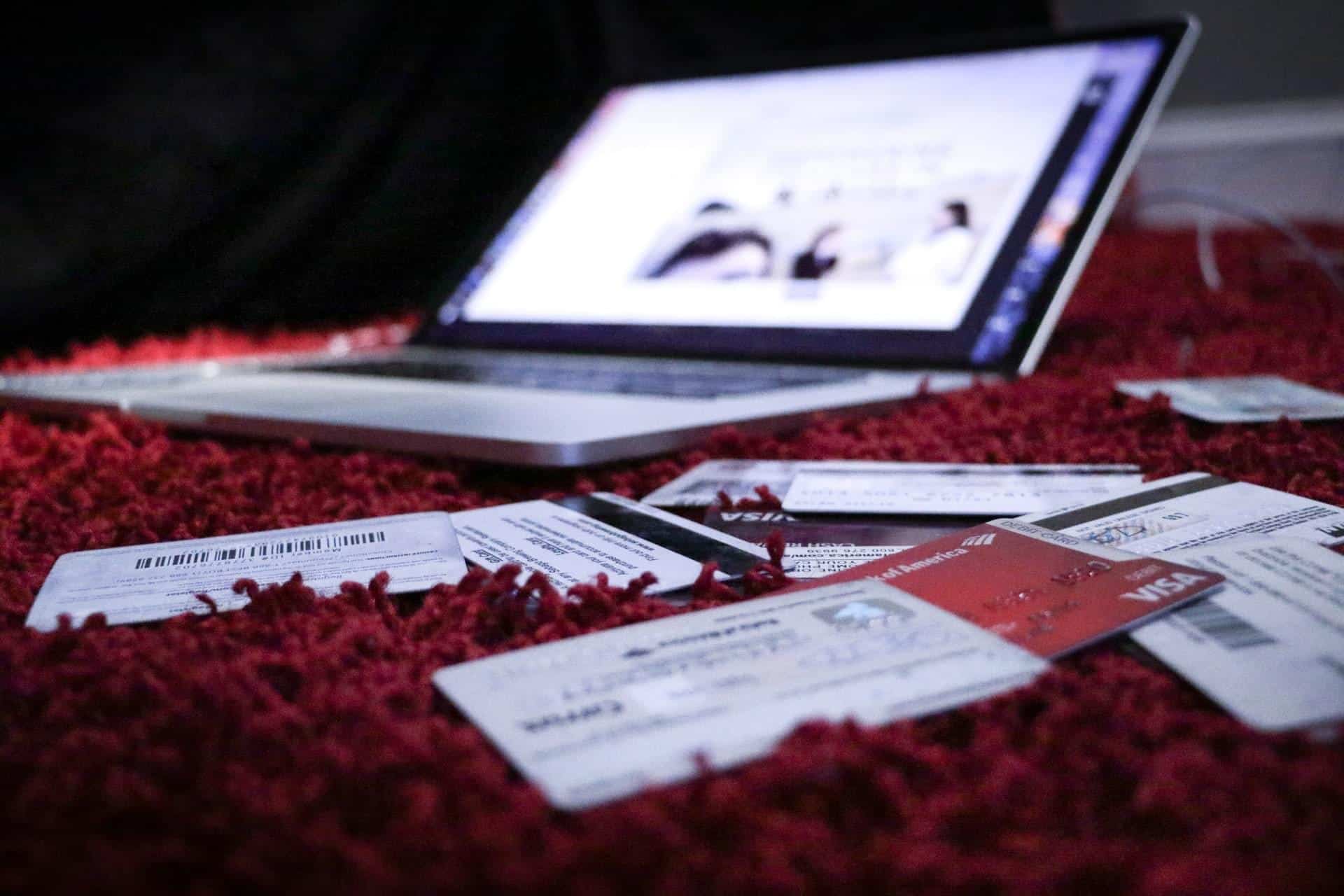

If a bill has been paid off but is still being reported as unpaid, it will have a negative effect on your score. The same is true for bills paid on time, but not reported. Instead of boosting your credit, there will be no effect at all. Checking your report can also alert you to any fraudulent activity under your name that may be pulling your score down.

Correct or Dispute Errors on Your Report

Once you check your credit report, it is important to note any errors or erroneous entries. For mistakes, it is important to contact the companies who made the reports to have them fixed. For errors, dispute them to have them removed from your credit report completely.

5% of all credit reports in the US contain at least one error, and the majority of these errors cause credit scores to go down. If you don’t have success getting companies to correct their mistakes, it is also possible to dispute those entries as well. Once you file a dispute companies have 30 days to respond or the disputed items will be removed from your credit report automatically. Once mistakes and inaccuracies drop off, your credit score will start to improve.

Pay Down Your Debts

It is never a good idea to carry too many depts. Not only can it have a negative effect on your DTI, it can also have a negative effect on your credit score. One way to improve your score in a relatively short time frame is by paying off smaller debts and paying down larger ones. This will boost your score by reducing your DTI and also by increasing the health of your payment history. The snowball method is highly effective when trying to pay down credit card debt that is all in the same general interest rate category.

This is when you focus on small balances first and then tackling the larger bills. If you have credit cards or loans with high-interest rates, using the debt avalanche method is better. With this method, you will target the higher interest rate bills regardless of their amounts prior to paying off or paying down those with lower rates.

Make Timely Payments & Keep Old Lines of Credit

Having too many credits cards is never good for your credit score, however, the oldest credit cards you have will boost your score the most. Pay down or pay off your older credit cards and lines of credit, but keep them open instead of closing them down. This will boost your credit history and help raise your score.

The longer your credit history is, the better your score will be. Instead, close newer cards that you don’t use or those that you consolidated into lower-interest lines of credit. That being said, the most effective way to boost your score in a short period of time is by avoiding late payments and paying your bills on time. You can set up automatic payments to come out of your checking account to ensure that you don’t miss any payments while you are working on your score.

Hire A Credit Repair Company

If you have followed all of these tips but still need to boost your score further, it may be worth it to consider hiring a credit repair company to help. They will do a lot of the same things to improve your score, only they will be able to do it much more efficiently and with a higher percentage of success. There is a small fee for using the service, but their expertise in the field can do wonders for your score. If you are looking for ways to consolidate medical debt or credit card debt, working with a credit repair company is a great way to go about it. With our tips you can fix your credit score in as little as six months, so what are you waiting for?